This course will take you through various aspect of using MYOB Reporting features to generate reports that you give you useful data about business performance and other aspects of the business operations.

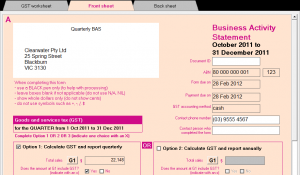

This course covers Balance Sheet and Profit and Loss Reports as well as GST reports and how to complete your BAS using MYOB’s BASlink. You’ll learn how to setup your BAS Info and backup the completed BAS report for that period.

This course covers Balance Sheet and Profit and Loss Reports as well as GST reports and how to complete your BAS using MYOB’s BASlink. You’ll learn how to setup your BAS Info and backup the completed BAS report for that period.

If you like what you see take a look at our MYOB Bookkeeping Training Course Packages to find the training that suits your needs and your budget.

D.I.Y Accounting

All our courses come with some basic bookkeeping training videos for those of you who aren’t sure of the names of things and the basic concepts.

Introduction to DIY Accounting

Charts of Accounts Explained

DIY Tax Codes Information

Cash Vs. Accrual Accounting Methods

Debits-Credits-Income-Expenses

Intro to Credit Control

MYOB Reporting GST and BAS Course

This section will take you through the reporting features of MYOB. Depending on the organisation you work for or the reporting goals of the business owners you will use different reports at different time intervals.

504101 – Introduction to MYOB Reporting

504102 – Customising the MYOB Profit and Loss Report

504103 – Changing the Display Formatting of MYOB Reports

504201 – Introduction to MYOB v 2011

504202 – Where do we see GST in source documents and accounts list

504203 – GST and Tax Code reports for Accrual and Cash Accounting

504204 – BAS Info and intro to BASlink

504205 – GST calculations for Sales and non-capital purchases to show the GST owing

504206 – Compare the BASlink info to the GST Detail Reporting for Cash Accounting

Exporting Data from MYOB

Your MYOB data file holds an incredible amount of information about your business and if you have the right Microsoft Excel skills you can find out a wealth of extra performance information about your business.

This section takes you through the exporting process in MYOB.

504301 Export via the Import/Export Assistant

504302 Export Employee Details via the Report Centre

Tracking Jobs

504401 – JOBS – Setting up a new job

504402 – JOBS – Budgets

504403 – JOBS – Allocating Expenses

504404 – JOBS – Allocating Revenue

504405 – JOBS – Closing the Job

504406 – JOBS – Reporting

Assets & Depreciation

On the 1st July 2012 the ATO announced an increase in the Assets and Write-Off’s for small businesses turning over less than $2M. Prior to 1 July 2012 this amount was $1,000 and from 1 July this amount increased considerably to $6,500, excluding the GST. This is a great help for the smaller businesses and that’s why we decided to put in a section specifically for this. In 2014 it changed again so regardless of the amounts, these videos will show you how to use MYOB to handle asset purchases and depreciation.

504601 – MYOB Reporting-Assets and depreciation Less Than 6500

504602 – MYOB Reporting-Assets and depreciation-MV Purchase

504603 – MYOB Reporting-Assets and depreciation-Accelerated Deduction

504604 -MYOB Reporting-Assets and depreciation-General Small Business Pool Year 2

—

Workbook – 504 Asset & Depreciation PDF document

Test: 504 ( Assets & Depreciation) – Knowledge review Quiz

[button link=”https://computertrainingonline.com.au/myob-online-training-course/”]Course Outlines[/button] [button link=”https://computertrainingonline.com.au/myob-online-training-course/myob-bookkeeping-course-packages/”]MYOB Training Course Packages[/button] [button link=”https://computertrainingonline.com.au/enrol/” bg_color=”#089919″]Enrol Now[/button]