Description

End of Month, Bank Recs and Journal Entries

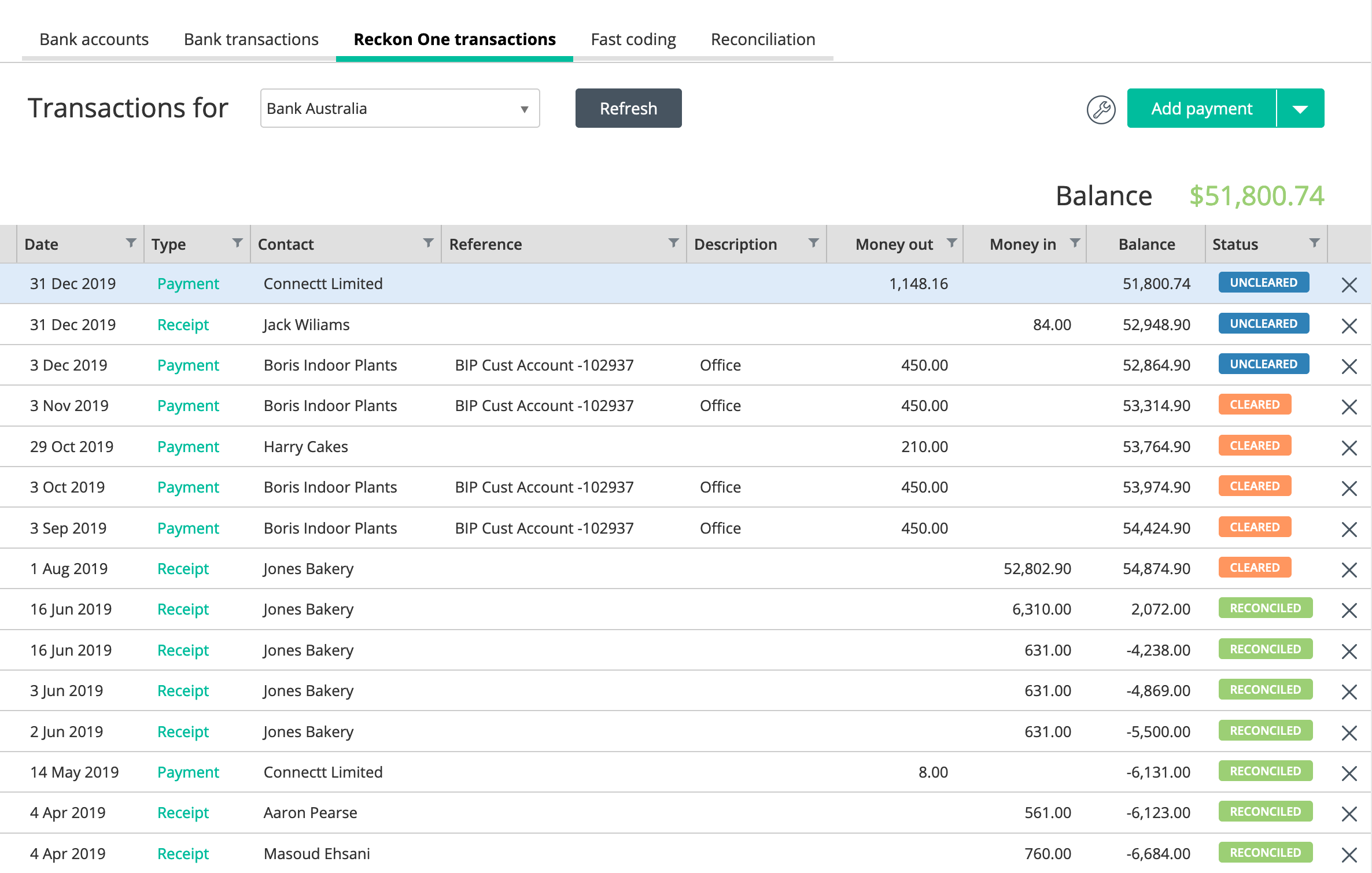

A bank reconciliation is performed once all of the day-to-day transactions have been entered into your software (unless you’re doing what is called Rescue Work or Catchup Work). The purpose of this bank reconciliation is to ensure that your software data matches the information in the real world (ie. your bank account). In the Reckon One Bank Reconciliation and Journal Entry Training Course we profile a small business startup.

The business owner lends the company money for cashflow, buys a car that needs to be depreciated, spends money on advertising and marketing to build awareness, makes some small sales and pays themselves a wage on an ad hoc basis depending on their bank balance.

These business include many trades and professional service organisations like Air conditioning, plumbing, building services, trades, electricians, tilers, painters, audio visual, security and monitoring, pest control, landscape gardeners and more

The Course includes the Reckon One training workbook with step-by-step tasks to compliment the educational videos. You’ll perform these steps using real life data.

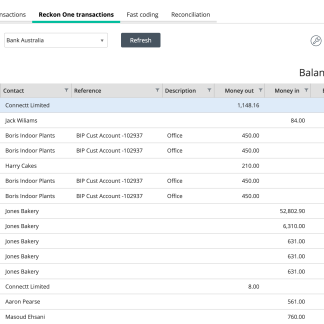

Bank Feeds and Reconciliation

You’ll learn how to begin a bank reconciliation, edit incorrect transactions and come to a fully balanced reconciliation.

Regular Financial Reporting

Once the reconciliation is complete you’ll run Run a Bank Reconciliation Report and a General Ledger Report.

Journal entries

Most of the above transactions are based on what’s called accrual accounting which means to keep track of money owed and money owing. At the end of each month you’ll learn how to perform a bank reconciliation and record transactions based on what is called cash accounting.

Wages, Assets Purchases, Depreciation and Correcting Mistakes

Cash based transactions include Spend Money Transactions, Receive Money Transactions and you’ll learn to perform the transactions that appear on your bank statement from automatic payments as well as to handle payroll on an adhoc basis based on individual payment transactions for things like wages, asset purchases, depreciation and incorrect transactions.

Reckon One Beginners Certificate

After successfully completing all assessment tasks and tests as part of this beginners course you’ll receive a Reckon One Certificate from National Bookkeeping.

If you decide you progress with your studies you can take advantage of our Industry Connect and Membership Directory to get discovered for accounting Jobs, Accounting Tutor jobs and bookkeeping work.