Description

Xero Payroll Beginners Certificate Training Course

Cloud-based accounting software is always up-to-date so PAYG tables and other information like Superannuation percentages are included with the software with no need to go through an updating/upgrading process.

The Cloud-based Xero software also enables bookkeepers/accountants to perform Payroll processing tasks from wherever they are which is great in the case of sickness or urgent matters.

This course is ideal for:

- Job seekers

- Business owners & office admin staff

- Junior accounts staff who want career progression

Xero Payroll Setup

- Xero Payroll Course – Setting our user permissions

- Xero Payroll Course – Payroll Settings – Linked Account Setup (r)

- Xero Payroll Course – Payroll Settings – Payslips Setup

- Xero Payroll Course – Payroll Settings – Pay Items Setup

- Xero Payroll Course – Payroll Settings – Calendar Setup

- Xero Payroll Course – Payroll Settings – Super Setup

Manage your Employees

- Xero Payroll Course – Employees – Details

- Xero Payroll Course – Employees – Employment

- Xero Payroll Course – Employees – Tax Declaration

- Xero Payroll Course – Employees – Leave

- Xero Payroll Course – Employees – Bank Accounts

- Xero Payroll Course – Employees – Pay Template

- Xero Payroll Course – Employees – Opening Balances

Processing Payroll using Xero

- Xero Payroll Course – Timsheets – Entering Timesheet Information

- Xero Payroll Course – Pay Runs – Posting a simple pay run

- Xero Payroll Course – Pay Runs – Pay Run Options

- Xero Payroll Course – Create a New Company File

- Xero Payroll Course – Set up your Company Details

- Xero Payroll Course – Add your Payroll Bank Account

- Xero Payroll Course – Set up your Payroll Liability and Expense accounts

- Xero Payroll Course – Create Pay Calendars

- Xero Payroll Course – Create Employee Cards

Xero Payroll Course – Payroll Dashboard

- Xero Payroll Course – Familiarise Yourself with the Pay Items

- Xero Payroll Course – Allowances, Termination Payment, Ordinary Hours, Overtime hours and more

- Xero Payroll Course – Deductions, Reimbursements and Leave Categories

- Xero Payroll Course – FBT, Leave Payments, Post-Tax and Pre-Tax Deducations

- Xero Payroll Course – Pay Templates

- Xero Payroll Course – Information about the Superannuation Guarantee

- Xero Payroll Course – Superannuation Types – Fixed, Percentage of Earnings or Statutory Rate

- Xero Payroll Course – Setting Pay Periods

- Xero Payroll Course – Perform a Pay Run

- Xero Payroll Course – Print & Email Pay Slips to Employees

- Xero Payroll Course – Pay Runs & Payroll Activity Reports

- Xero Payroll Course – Suggestions/Recommendations

- Xero Payroll Course – Create a Card for a New Company Employee

- Xero Payroll Course – Create a New Account

- Xero Payroll Course – Create a New Pay Item

- Xero Payroll Course – Update Employee Payroll Details & Perform Pay Runs

- Xero Payroll Course – Edit a Pay Run

Xero Payroll Reporting Course

- Xero Payroll Course – Print a Payroll Activity Summary Report

- Xero Payroll Course – Print a Payroll Employee Summary

- Xero Payroll Course – Reconcile Superannuation & Wages

- Xero Payroll Course – Reconcile the PAYG Taxes

- Xero Payroll Course – Reconcile Liabilities to Balance Sheet

EOY Xero Payroll Procedures

- Xero Payroll Course – Create EMPDUPE

- Xero Payroll Course – Print out the Payment Summaries

Xero Payroll Course – Employer Obligation Information

- Differences between full-time, part-time and casual employees

- Salary Sacrificing

- Employer Obligations relating to Super

- Employee Eligibility Criteria for Superannuation

- Pay Slip Requirements

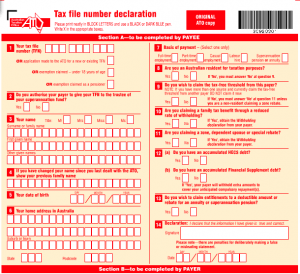

- TFN Declaration Forms

Xero Advanced Payroll Administration Training Course

- Xero Payroll Administration Course – Set up Timesheet Preferences

- Xero Payroll Administration Course – Edit an Existing Super Payroll Category

- Xero Payroll Administration Course – Create a New Super Payroll Category

- Xero Payroll Administration Course – Add a New Payroll Category

- Xero Payroll Administration Course – Edit Employment Classifications to Suit the Business

- Xero Payroll Administration Course – Create a Casual Employee in Xero

- Xero Payroll Administration Course – Create Permanent Employees in Xero

- Xero Payroll Administration Course – Enter Timesheets in Xero

- Xero Payroll Administration Course – Process a Pay Run

- Xero Payroll Administration Course – Import Timesheets

- Xero Payroll Administration Course – Process Payroll with Personal Leave included

- Xero Payroll Administration Course – Create a New Deduction Payroll Category

- Xero Payroll Administration Course – View Employee Leave Accrued

- Xero Payroll Administration Course – Process Pay including Annual Leave

- Xero Payroll Administration Course – Run a Payroll Entitlements Report

- Xero Payroll Administration Course – Run a Payroll Journal Report

- Xero Payroll Administration Course – Produce a Balance Sheet

- Xero Payroll Administration Course – Record your Bank Details

- Xero Payroll Administration Course – Record Employee Bank Details

- Xero Payroll Administration Course – Process a Pay Run

- Xero Payroll Administration Course – Create an Electronic Payment File

- Xero Payroll Administration Course – Process Final Pay

- Xero Payroll Administration Course – Update Employee Card File