Description

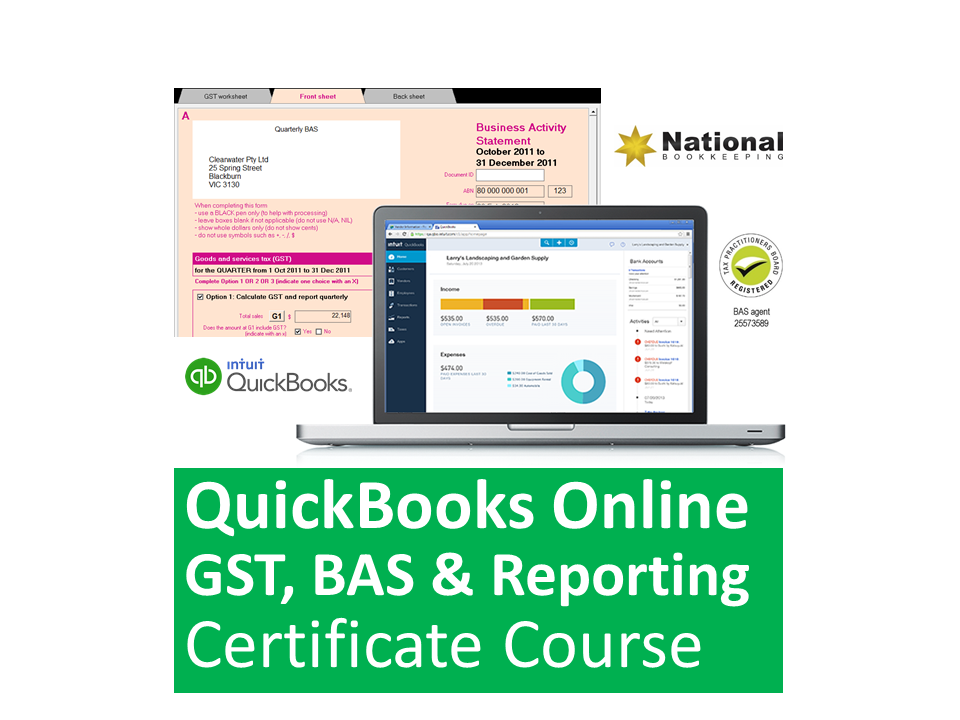

QuickBooks Online GST, Reporting & BAS Training Course

The course includes capital purchases (a vehicle) and includes the different costs of running a vehicle should be treated, as well as expenses like entertainment; when FBT applies and an introduction to Payroll where you’ll explore how various aspects of wages are treated in the BAS.

BAS Report and PAYG Introduction

After correctly coding all of these transactions, you’ll set up the Financial Settings of a Business in QuickBooks Online with regard to the GST registration (Cash vs Accrual and quarterly vs monthly). You’ll run a BAS report, which is combined with our specially-designed “Ad Hoc Payroll” Excel spreadsheet case study calculations in order to work out the final liabilities.

As you progress through this course you’ll see the results of the business owners ‘change of strategy’ and focus for the business. You’ll see what these results look like at the end of the quarter, as well as month-by-month comparisons of Profit and Loss and Balance Sheet reports.

Decisions Based on Financial Reports

At the end of the course you’ll explore how the business owner can use the information in the reports to change the direction of the business, as well as how he will be able to configure their software to obtain even better reports at the end of the next quarterly reporting period.

Apart from performing all of a businesses compliance requirements, decision making is one of the biggest reasons for business to maintain detailed records and use computerised accounting software.