Description

MYOB GST, Reporting & BAS Training Course

The course includes capital purchases (a vehicle) and includes the different costs of running a vehicle should be treated, as well as expenses like entertainment; when FBT applies and an introduction to Payroll where you’ll explore how various aspects of wages are treated in the BAS.

BAS Report and PAYG Introduction

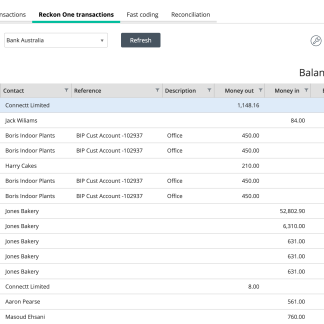

After correctly coding all of these transactions, you’ll set up the Financial Settings of a Business in Xero with regard to the GST registration (Cash vs Accrual and quarterly vs monthly). You’ll run a BAS report, which is combined with our specially-designed “Ad Hoc Payroll” Excel spreadsheet case study calculations in order to work out the final liabilities.

As you progress through this course you’ll see the results of the business owners ‘change of strategy’ and focus for the business. You’ll see what these results look like at the end of the quarter, as well as month-by-month comparisons of Profit and Loss and Balance Sheet reports.

Decisions Based on Financial Reports

At the end of the course you’ll explore how the business owner can use the information in the reports to change the direction of the business, as well as how he will be able to configure their software to obtain even better reports at the end of the next quarterly reporting period.

Apart from performing all of a businesses compliance requirements, decision making is one of the biggest reasons for business to maintain detailed records and use computerised accounting software.

MYOB Job Tracking and Reporting

There are many aspects to building and construction jobs, whether they are capital improvements to a pool, a new deck, house extension of even just a simple garden shed. Unless the builder or handy man performing this work is quoting a day rate plus expenses they’ll provide a fixed quote based on their best estimates.

Professional Builders who understand most of the potential pitfalls will provide a quote based on the cost of managing these risks and the MYOB Jobs Tracking and Reporting Course is designed to show you just how easy it is for even small job to blow out on budget and cost more than they earn.

MYOB Job Tracking Case Study

The cost to purchase a garden shed is cheap at several hundred dollars but here are some of the challenges that the handy man in our case study comes across:

Key elements in this case study are:

- Some of the products needed are in stock, but more will need to be bought to complete the job

- The base of the shed needs to be cement and that means you need formwork and metal reinforcement (rio)

- It takes two hours for the grass to be dug up and put aside

- A trip needs to be made to the hardware shop for wood, nails and rio for the formwork

- The formwork takes two hours to build

- One of the tradespeople has to go to Bunnings again to get the reinforcement and plastic sheeting that they forgot in the first trip

- It rains so they must leave the project for the day, after assembling the formwork

- They come back two days later (after completing another indoors job) and fill the formwork with concrete, bringing 10 bags of concrete from the depot and collecting another 10 bags from Mitre 10 on the way

- They fill the concrete and smooth it over then leave for the day

- Next Monday morning they go to the shed retailer and collect the shed to deliver it to the site (two hours in total after confirming that it has been paid and they have the right one – with the two sliding doors)

- They arrive at site and realise that their tools have no power; they need to ask the neighbour for use of their power and an extension cord

- They assemble the main outside frame but realise they need a third person and call for one of their workmates who is working 25 minutes away

- The 3rd worker is onsite for 30 minutes and the shed is fully assembled with roof and all.

In this case study you’ll understand the true cost of parts and labour to get this job done and run a Job Tracking Report to understand the Profit and Loss on this job/project