Description

Xero Payroll Beginners Certificate Training Course

Cloud-based accounting software is always up-to-date so PAYG tables and other information like Superannuation percentages are included with the software with no need to go through an updating/upgrading process.

The Cloud-based Xero software also enables bookkeepers/accountants to perform Payroll processing tasks from wherever they are which is great in the case of sickness or urgent matters.

This course is ideal for:

- Job seekers

- Business owners & office admin staff

- Junior accounts staff who want career progression

Xero Payroll Setup

- Xero Payroll Course – Setting our user permissions

- Xero Payroll Course – Payroll Settings – Linked Account Setup (r)

- Xero Payroll Course – Payroll Settings – Payslips Setup

- Xero Payroll Course – Payroll Settings – Pay Items Setup

- Xero Payroll Course – Payroll Settings – Calendar Setup

- Xero Payroll Course – Payroll Settings – Super Setup

Manage your Employees

- Xero Payroll Course – Employees – Details

- Xero Payroll Course – Employees – Employment

- Xero Payroll Course – Employees – Tax Declaration

- Xero Payroll Course – Employees – Leave

- Xero Payroll Course – Employees – Bank Accounts

- Xero Payroll Course – Employees – Pay Template

- Xero Payroll Course – Employees – Opening Balances

Processing Payroll using Xero

- Xero Payroll Course – Timsheets – Entering Timesheet Information

- Xero Payroll Course – Pay Runs – Posting a simple pay run

- Xero Payroll Course – Pay Runs – Pay Run Options

- Xero Payroll Course – Create a New Company File

- Xero Payroll Course – Set up your Company Details

- Xero Payroll Course – Add your Payroll Bank Account

- Xero Payroll Course – Set up your Payroll Liability and Expense accounts

- Xero Payroll Course – Create Pay Calendars

- Xero Payroll Course – Create Employee Cards

Xero Payroll Course – Payroll Dashboard

- Xero Payroll Course – Familiarise Yourself with the Pay Items

- Xero Payroll Course – Allowances, Termination Payment, Ordinary Hours, Overtime hours and more

- Xero Payroll Course – Deductions, Reimbursements and Leave Categories

- Xero Payroll Course – FBT, Leave Payments, Post-Tax and Pre-Tax Deducations

- Xero Payroll Course – Pay Templates

- Xero Payroll Course – Information about the Superannuation Guarantee

- Xero Payroll Course – Superannuation Types – Fixed, Percentage of Earnings or Statutory Rate

- Xero Payroll Course – Setting Pay Periods

- Xero Payroll Course – Perform a Pay Run

- Xero Payroll Course – Print & Email Pay Slips to Employees

- Xero Payroll Course – Pay Runs & Payroll Activity Reports

- Xero Payroll Course – Suggestions/Recommendations

- Xero Payroll Course – Create a Card for a New Company Employee

- Xero Payroll Course – Create a New Account

- Xero Payroll Course – Create a New Pay Item

- Xero Payroll Course – Update Employee Payroll Details & Perform Pay Runs

- Xero Payroll Course – Edit a Pay Run

Xero Payroll Reporting Course

- Xero Payroll Course – Print a Payroll Activity Summary Report

- Xero Payroll Course – Print a Payroll Employee Summary

- Xero Payroll Course – Reconcile Superannuation & Wages

- Xero Payroll Course – Reconcile the PAYG Taxes

- Xero Payroll Course – Reconcile Liabilities to Balance Sheet

EOY Xero Payroll Procedures

- Xero Payroll Course – Create EMPDUPE

- Xero Payroll Course – Print out the Payment Summaries

Xero Payroll Course – Employer Obligation Information

- Differences between full-time, part-time and casual employees

- Salary Sacrificing

- Employer Obligations relating to Super

- Employee Eligibility Criteria for Superannuation

- Pay Slip Requirements

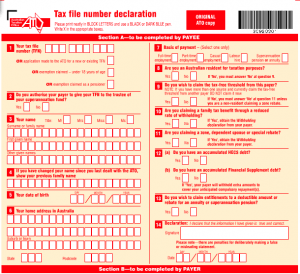

- TFN Declaration Forms

Get HR Support for Small Businesses

If you are a small business owner or manager enrolled into this course you’ll have access to our online HR Support Service.

Ensure that all your staff are on the correct award and receiving their entitlements.

With major issues facing well known businesses underpaying their staff this service will help you understand the legal requirements and point you in the right direction to ensure you are compliant and remain compliant.

Xero Advanced Payroll Administration Training Course

- Xero Payroll Administration Course – Set up Timesheet Preferences

- Xero Payroll Administration Course – Edit an Existing Super Payroll Category

- Xero Payroll Administration Course – Create a New Super Payroll Category

- Xero Payroll Administration Course – Add a New Payroll Category

- Xero Payroll Administration Course – Edit Employment Classifications to Suit the Business

- Xero Payroll Administration Course – Create a Casual Employee in Xero

- Xero Payroll Administration Course – Create Permanent Employees in Xero

- Xero Payroll Administration Course – Enter Timesheets in Xero

- Xero Payroll Administration Course – Process a Pay Run

- Xero Payroll Administration Course – Import Timesheets

- Xero Payroll Administration Course – Process Payroll with Personal Leave included

- Xero Payroll Administration Course – Create a New Deduction Payroll Category

- Xero Payroll Administration Course – View Employee Leave Accrued

- Xero Payroll Administration Course – Process Pay including Annual Leave

- Xero Payroll Administration Course – Run a Payroll Entitlements Report

- Xero Payroll Administration Course – Run a Payroll Journal Report

- Xero Payroll Administration Course – Produce a Balance Sheet

- Xero Payroll Administration Course – Record your Bank Details

- Xero Payroll Administration Course – Record Employee Bank Details

- Xero Payroll Administration Course – Process a Pay Run

- Xero Payroll Administration Course – Create an Electronic Payment File

- Xero Payroll Administration Course – Process Final Pay

- Xero Payroll Administration Course – Update Employee Card File

Get up-to-date information about this training

Get course information, promotion discounts or just ask us a question

"*" indicates required fields