Description

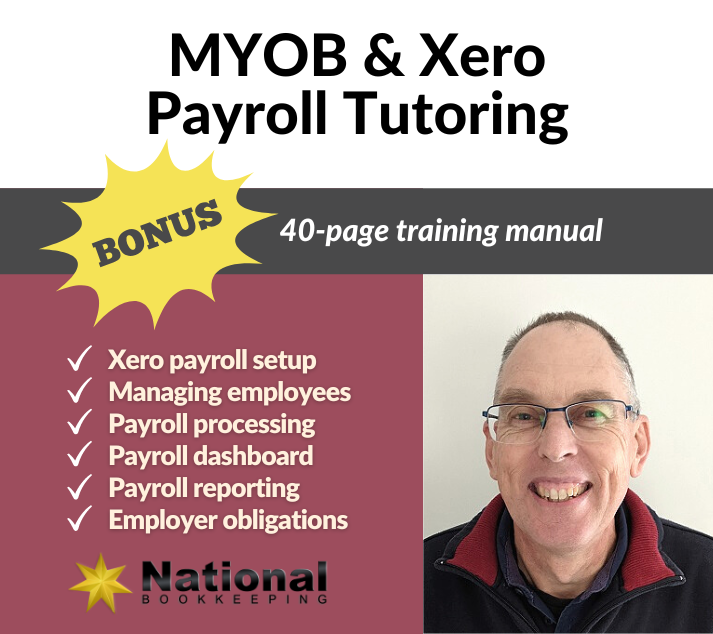

Get help with MYOB, Xero or QuickBooks Payroll training. Your payroll tutor will help you answer all the questions you have at a time that suits you.

This service is remote and via phone, email, website chat, SMS and screenshare on Zoom – which ever suits the circumstances.

Topics Included

Xero & MYOB Payroll Training Course

Cloud-based accounting software is always up-to-date so PAYG tables and other information like Superannuation percentages are included with the software with no need to go through an updating/upgrading process.

The Cloud-based Xero and MYOB Business software enables bookkeepers/accountants to perform Payroll processing tasks from wherever they are which is great in the case of sickness or urgent matters.

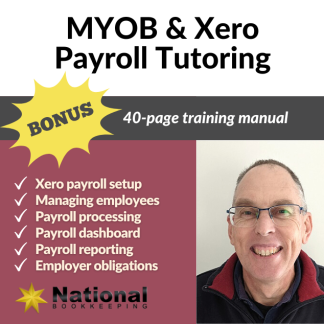

Detailed and Practical QuickBooks, MYOB or Xero Payroll Training Course Manual

This Xero or MYOB One to one tutoring and training package includes a 40 page training manual that is packed with practical tasks and exercises that you can perform using sample data.

The Xero or MYOB Payroll training manual exercises will give you practice for most of the daily, data entry that accounting staff perform for a business for payroll administration.

Xero Payroll Setup

- Xero Payroll Course – Setting our user permissions

- Xero Payroll Course – Payroll Settings – Linked Account Setup (r)

- Xero Payroll Course – Payroll Settings – Payslips Setup

- Xero Payroll Course – Payroll Settings – Pay Items Setup

- Xero Payroll Course – Payroll Settings – Calendar Setup

- Xero Payroll Course – Payroll Settings – Super Setup

Manage your Employees

- Xero Payroll Course – Employees – Details

- Xero Payroll Course – Employees – Employment

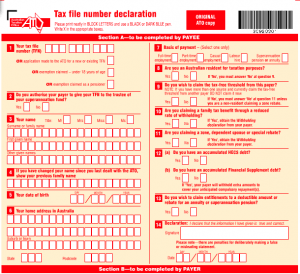

- Xero Payroll Course – Employees – Tax Declaration

- Xero Payroll Course – Employees – Leave

- Xero Payroll Course – Employees – Bank Accounts

- Xero Payroll Course – Employees – Pay Template

- Xero Payroll Course – Employees – Opening Balances

Processing Payroll using Xero

- Xero Payroll Course – Timsheets – Entering Timesheet Information

- Xero Payroll Course – Pay Runs – Posting a simple pay run

- Xero Payroll Course – Pay Runs – Pay Run Options

- Xero Payroll Course – Create a New Company File

- Xero Payroll Course – Set up your Company Details

- Xero Payroll Course – Add your Payroll Bank Account

- Xero Payroll Course – Set up your Payroll Liability and Expense accounts

- Xero Payroll Course – Create Pay Calendars

- Xero Payroll Course – Create Employee Cards

Xero Payroll Course – Payroll Dashboard

- Xero Payroll Course – Familiarise Yourself with the Pay Items

- Xero Payroll Course – Allowances, Termination Payment, Ordinary Hours, Overtime hours and more

- Xero Payroll Course – Deductions, Reimbursements and Leave Categories

- Xero Payroll Course – FBT, Leave Payments, Post-Tax and Pre-Tax Deducations

- Xero Payroll Course – Pay Templates

- Xero Payroll Course – Information about the Superannuation Guarantee

- Xero Payroll Course – Superannuation Types – Fixed, Percentage of Earnings or Statutory Rate

- Xero Payroll Course – Setting Pay Periods

- Xero Payroll Course – Perform a Pay Run

- Xero Payroll Course – Print & Email Pay Slips to Employees

- Xero Payroll Course – Pay Runs & Payroll Activity Reports

- Xero Payroll Course – Suggestions/Recommendations

- Xero Payroll Course – Create a Card for a New Company Employee

- Xero Payroll Course – Create a New Account

- Xero Payroll Course – Create a New Pay Item

- Xero Payroll Course – Update Employee Payroll Details & Perform Pay Runs

- Xero Payroll Course – Edit a Pay Run

Xero Payroll Reporting Course

- Xero Payroll Course – Print a Payroll Activity Summary Report

- Xero Payroll Course – Print a Payroll Employee Summary

- Xero Payroll Course – Reconcile Superannuation & Wages

- Xero Payroll Course – Reconcile the PAYG Taxes

- Xero Payroll Course – Reconcile Liabilities to Balance Sheet