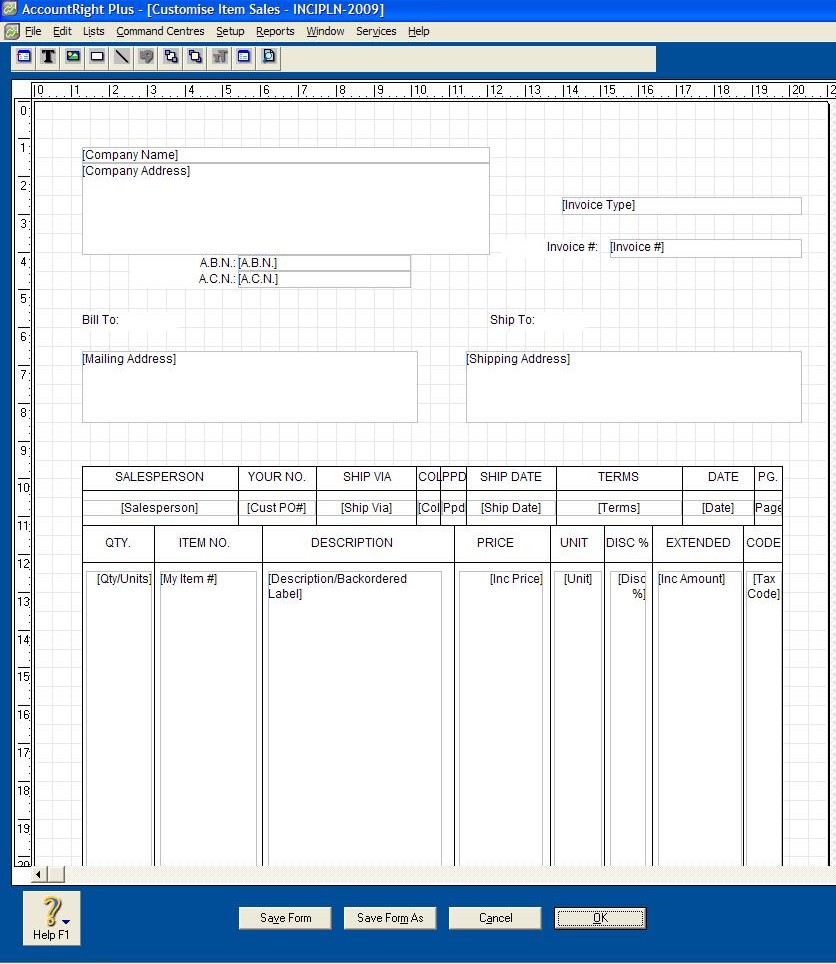

In ‘Customise Forms’, MYOB gives you several options.

First, you can select the option INCIPLN which is Tax Inclusive Plain Paper Invoice. Then click on Customise.

You will see with this option that under the Heading ‘Price’, it has Inc Amount. Under the Heading ‘Extended’ it also has Inc Amount. This shows you that the amounts entered will be GST Inclusive. (Note: The Heading ‘Extended’ gives you the total amount, whereas the amount under Heading ‘Price’ gives you the unit amount.)

The difference between Ex Amount and Inc Amount can be explained as follows:

Ex Amount GST (10%) Inc Amount

Item Cost $55.00 $5.50 $60.50

If you select the Plain Paper invoice, you’ll note that under Headings ‘Price’ and ‘Extended’ it states Ex Amount. This means that it is GST Exclusive.

Most customers / clients prefer to see the full amount they will be paying. You will have to decide which type of Invoice your company prefers.

Video Reference: 501603

Link for existing students: http://ezylearnonline.com.au/training/mod/resource/view.php?id=384

Receive EzyLearn news, new training materials and updates as they occur by subscribing to the blog: www.ezylearn.com.au/wordpress

For information about our Online MYOB Training Course and new Lifetime Membership for all students, please visit: www.ezylearnonline.com.au/courses/myob-training/

Please feel free to send your comments about this video to: sales@ezylearn.com.au