After reviewing the accounting skills requirements for accounting jobs on Seek and Indeed it’s obvious that Xero has made amazing inroads into the accounting software space.

Small businesses appear to be the ones most quickly adopting Xero’s cloud accounting software and because they are a significant employer many jobs now require Xero skills.

The negative impact on job seekers and those re-entering the workforce for part-time accounting jobs is that you’ll be able to apply for more jobs with knowledge of how to use both Xero and MYOB and now you can for just $25 per week.

Continue reading MYOB & Xero Short Courses $25 per week

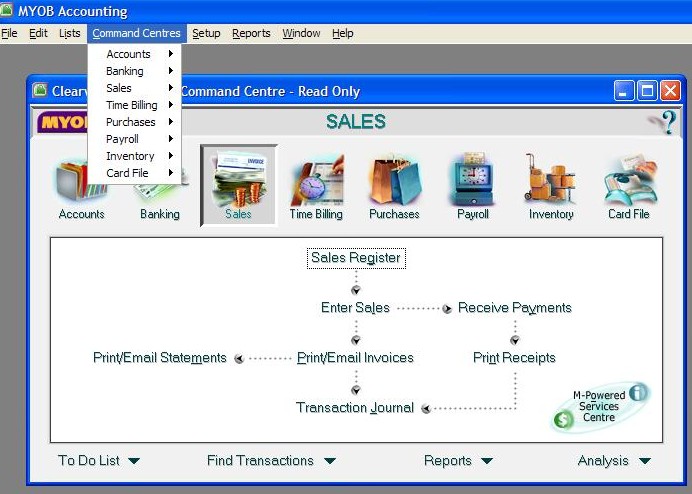

MYOB Jobs

MYOB Jobs Upon further investigation as to why this was happening, I got my answer:

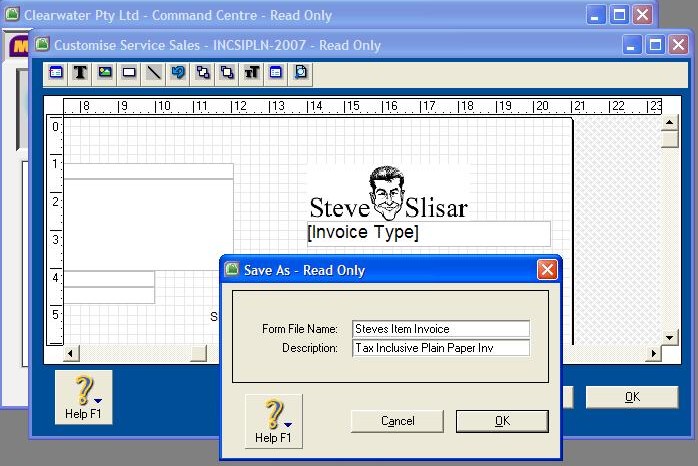

Upon further investigation as to why this was happening, I got my answer: We are thrilled to announce the development of new training course videos for our

We are thrilled to announce the development of new training course videos for our